Merchant Processing Solutions Inc. is a local south Florida company that provides merchant processing solutions to its merchants. We pride ourselves on honest rates, innovative solutions and intelligent technology to meet our customers' needs. We believe that our customer is NUMBER ONE so their needs have become ours. We offer local support during the installation process and we understand what is going on behind every transaction. Building Relationships not just Transactions.....

Thursday, December 17, 2020

Thursday, December 3, 2020

One good thing about COVID19; It has created CHANGE AND INNOVATION!

|

| COVID -19 PANDEMIC CLOSES THE GLOBAL ECONOMY |

|

| THE NEW BUSINESS WORLD |

COVID-19 has been a tremendous economic shock and burden on our society. Over the last 6 months, once businesses started to open to new regulations and concerned customers, the focus began to shift towards ways to address health and safety risks while also keeping the doors OPEN! Businesses have historically not changed much on how they run their business; implementing the saying," if it ain't broken...don't fix it!" Over the years, the introduction of new technologies has slowly brought the business world to change but in this pandemic, many were unprepared to make the necessary shift. Businesses need to change technologies, business practices, and strategies that improve customer and employee safety by mitigating the risk of contagion.

As we move to 2021, all businesses small and large need to look at their business. This month represents the time to assess your current operations and decide how to adjust in the COVID and post-COVID world.

- Review your balance and financial statements for 2020 & Prepare for 2021.

- Make any pivotal changes in your business to address the concerns of your customers and employees.

- Plan, Plan, Plan... create a best-case, a baseline, and a worst-case scenario that will show creditors, investors, lenders, customers, and suppliers that you are serious about keeping your business open.

- Use your local resources: Chamber of Commerce, SCORE, Office of Economic Development, your suppliers and customers to get a handle on what you need to do in 2021 to not ONLY keep your doors open but grow!

MERCHANT PROCESSING SOLUTIONS

954-938-2420

Wednesday, November 18, 2020

Recurring Payment Acceptance helps both customers and businesses!

Recurring payments benefit consumers!

Consumers enjoy the convenience of auto pay that automatically deducts a pre-arranged payment for your business services. They don’t have to worry about payments, so they’re free to focus on the experiences and value your business offers. Other recurring payments benefits for customers include:

- Customers often purchase more when payments can be made on said purchase

- Automated receipts sent to text or email

- Ability to easily update payment method and subscriptions levels

- Flexible payment amounts and terms meeting each customer's needs

Recurring billing payments benefit businesses too!

- Customers can buy now and space payments over a period of time to help prompt sales

- Customers may decide to purchase or purchase MORE when Recurring Billing is offered

- Fewer late payments and more predictable cash flow

- Enhanced customer loyalty by making payments simple, easy and worry-free

- Eliminated costs associated with manual billing, mailing, and postage

Contact a Merchant Processing Solutions payment expert to learn how a recurring payment gateway can power customer payments, help keep your customers happier and accelerate your revenue while reducing costs.

MERCHANT PROCESSING SOLUTIONS

954-938-2420

Thursday, November 12, 2020

Are you REALLY open for business?

Customers today approach purchasing differently and businesses need to follow their lead! The top selling companies in the United States are implementing customer friendly options for shopping:

- WALMART - They have increased their online sales by 37% since January 2020. Offering online shopping for "in-store" pick -up or delivery to your car. They also offer home delivery and depending on the amount their Shipping & Handling is FREE! has added a very friendly mobile app for any of the purchasing options mentioned above.

- KROGER FAMILY OF GROCERY STORES - They have added store Apps to allow customers to order on the app for home delivery, pick-up or just quick purchase in-person. Kroger's saw their online sales soar by 92% in the first quarter of 2020! They had added thousands of jobs for delivery drivers across the nation as more and more people purchase for home delivery!

- COSTCO - The 3rd largest retail store in the nation has also had to change their shopping options to include online ordering for either store pick-up or home delivery. They do not offer to store pick-up to car delivery and that has brought criticism to the store that prides on innovation and customer satisfaction. COSTCO still wants people in their store to capture the impulse purchases which critics say is not a good enough reason to put people at risk.

Merchant Processing Solutions

954-938-2420

Monday, November 9, 2020

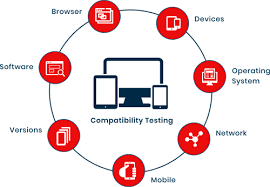

Are your payment acceptance connections compatible?

I recently got a call from a log-time merchant of Merchant Processing Solutions who asked how she could connect her new client online POS to work with our company. I asked her the name of the company and the software, I had not hear of them at all! I asked if we was test the product of had they already purchased it and of course it had been purchased and they were uploading their data when I got the call!! YIKES....

|

| Are you purchasing compatibility in your solutions? |

She found out that this company ONLY used one gateway provider and not the one she had used for 6 years! So now the choice is : 1) Do we just move forward with the new software and payment gateway and manually enter all the data into our system or 2) Do we look for a different software that will work with our current payment gateway/merchant provider?? Either way, it will cost her time and money having not know first about her payment acceptance compatibility.

Of course, all of this could have been averted had they contacted us first to discuss their new needs and options to fulfill that need. Merchant Processing Solutions is a Partner to our merchants and as such, we want to be part of your decision making to give you valuable insight into our industry as well as the products and services necessary for your business to grow!

If you are looking to implement more software of plug-ins to your current payment acceptance system, call us for a FREE consultation!

Merchant Processing Solutions

954-938-2420

Friday, October 23, 2020

Rebooting your business!

Here are several steps being hailed as imperative to Reboot Your Business!

1. Reimagine and Transform: This requires more than business as usual, it requires a look at your customers and understand what makes them comfortable to shop/eat/use your facility! Its definitely a balancing act between growing the business and making your business "feel" safe for your customers.

|

| Customer prefer to buy online! Does your business have an online presence where your customers can buy your products and services? |

2. Addressing Customer Anxiety: Previously, customers made decisions to purchase based on need, price, and desires. Today, customers want safety first even before price! They are willing to pay more to keep themselves and their family from risk. EY Global reported that 44% of global consumers say they are more likely to go grocery shopping online as a result of the pandemic! In order to survive this "new reality" businesses will have to have an online presence that makes it easy for customer to find them and buy from them!

|

| Customer Anxiety makes more than 40% of grocery shopper order online! |

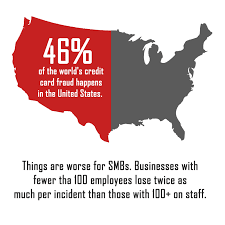

3. Identify legal and fraud issues: Businesses that lack understanding in their customers' and employees' fear about this pandemic, can create a legal nightmare for business owners. Making sure that making money takes over safety issues is a tricky balance, especially in a sales environment where sales are incentivized. Over extending or laxing Covid -19 Regulations can cause a business to be shut down and lose money.

One the other hand, businesses that use the technique of having customers call in and pay with a credit card are potentially at risk of those cards being stolen by employees and used fraudulently! Websites are also being "phished" or "hacked" so it now time to stop using your kids to create and maintain your website. Professional web developers know how to keep your website safe and you from paying thousands in either processing fees or chargebacks!

|

| Phishing incidents uses your website to test credit card numbers.. this can cost you thousands of dollars in Merchant Fees! |

4. Flexibility, adaptation and resilience: Our economy was already facing many changes to the buying and selling experience prior to the pandemic. Radical changes on how we operate our businesses are necessary to survive and grow in today's recovery environment. Being flexible both internally and externally will be critical to survival and growth. As consumers adapt to our changing world, so will your business to their wants and needs!

|

| Learning to be flexible, adapt to necessary changes quickly and cultivating positive attitudes will get you through these New Realty! |

By preparing your business and employees for reopening and recovery, you must go slow and steady. Being flexible to the needs of your customers, adapting to their wants and needs. And finally, be resilient in how you approach your business! Believe in your people, industry, product and service to the community. Be helpful to your community and be active in EVERYONE'S recovery. Cultivate a positive attitude towards your survival, recovery and growth... and it will happen!

If you would like any advice about merchant processing, POS Systems or just a consultation on how we can help you create safe environment for your employees and customers, Call Us Today!

Merchant Processing Solutions

954-938-2420

Wednesday, September 30, 2020

Want Lower Rates for Quickbooks Processing...we have the answer!

Sync Payment Data to QuickBooks Online Automatically!!

Manually tracking sales data can become an accounting nightmare!

With MX™ QuickBooks Sync, merchants can synchronize financial data from the MX™ Merchant payment platform to Intuit’s QuickBooks Online tool. MX™ QuickBooks Sync automatically updates daily transaction data to QuickBooks Online, including all transactions, customer information, invoices and more!

MX™ QuickBooks Sync automatically syncs from MX Merchant into your Quickbooks Online Account:

- New and existing Customer information is added along with payments

- Payments are tracked from all MX Merchant Connection Points: Online, Invoice, Recurring, Mobile and Website.

- Invoicing and Recurring payments can manage multiple invoicing systems tracking payments

- No more manually entering daily transactions or customer data

Save time and reduce accounting errors by activating the MX™ QuickBooks Sync App today!

- Your Point of Sale Software does not allow you to SYNC with Quickbooks?

- Your Point of Sale Software does not have multiple connection points to take payments?

- Are you tired of manually entering data into your Quickbooks Online Account?

- Are you looking for more bang for your money?

- Would you like more time to do other value to your business?

Call Merchant Processing Solutions today @ 954-938-2420

- Your Point of Sale Software does not allow you to SYNC with Quickbooks?

- Your Point of Sale Software does not have multiple connection points to take payments?

- Are you tired of manually entering data into your Quickbooks Online Account?

- Are you looking for more bang for your money?

- Would you like more time to do other value to your business?

Call Merchant Processing Solutions today @ 954-938-2420

Wednesday, September 23, 2020

Check Out Clover!

Check Out Clover for your Business!

Merchant Testimonial on how Clover has helped in their business and it can be the solution for yours too!

Call Merchant Processing Solutions today to see if

a Clover Solution is right for your business!

954-938-2420

Tuesday, September 8, 2020

Tuesday, September 1, 2020

B2B Merchants need Level II & Level III Auto Processing!

Businesses run on Credit Cards Transactions! But most B2B Businesses are unaware of the difference between Consumer Credit Cards and Business Credit Cards. Most processors don't even want you to know because they make more money off of you! If the majority of your business is with other businesses, then you want to know about this phenomenal software that Merchant Processing Solutions offers for its B2B Merchants!

B2B transactions are payments made between two merchants/businesses for goods or services. Very few businesses still utilize checks and cash, B2B credit card payments are increasingly more popular, and more convenient for companies to be able to make, receive, and process payments faster and with more benefits. But most Business Merchants are unaware of the substantial savings that can be had by implementing our B2B Optimizer Software.

First you need to understand that there are three different data levels for credit cards; Level 1, Level 2, and Level 3. Each level requires a certain data to qualify transactions, and the higher the level is, the more details required. The higher the data levels, the lower the interchange rates from most credit card companies.

|

| Business to Consumer Transactions |

Level 1 credit card processing is the most common level it is for B2C Merchants (Business to Consumers). All Consumer credit cards are set up on Level I data capture. Most merchants know if they don't enter the right Zip Code or Address, they can be declined the transaction etc.

Level I data processing includes: Commonly required on Terminals, Mobile, Virtual Terminal and Website Payment Acceptance connections.

- Credit card number

- Expiration Date

- CVV Code

- Billing address

- Zip code

Level II data processing saves businesses money on processing costs. Savings come from lowering the interchange rates that are dictated by VISA/MasterCard/Discover/American Express Associations. Interchange rates are reduced by about 0.50 percent lower than Level 1 transactions depending on the Association. Level II also helps prevent potential fraud or chargebacks to your business due to the added data requirements.

To qualify for Level II processing, a merchant needs software to capture the following data:

|

- Credit card number

- Expiration date

- CVV Code

- Billing address

- Zip Code

- Sales tax amount

- Customer code

- Merchant postal code

- Merchant tax identification number

- Invoice number

- Order number

Level III data processing is used in B2B (Business to Business) and B2G (Business to Government) transactions to help large corporations monitor and track their spending by collecting a set of additional line-item details. Entering extra data into the transaction fields offers significantly lower interchange rates for Association transactions. Level 3 interchange rates can be a full 1.00 percent lower than their Level I!

To qualify for Level III processing, a merchant needs software to capture the following data:

- Credit card number

- Expiration date

- CVV Code

- Billing address

- Zip code

- Sales tax amount

- Customer code

- Merchant postal code

- Merchant tax identification number

- Invoice number

- Order number

- Ship-From Zip Code

- Destination Zip Code

- Invoice Number

- Order Number

- Item Product Code

- Item Commodity Code

- Item Description

- Item Quantity

- Item Unit of Measure

- Item Extended Amount

- Freight Amount

- Duty Amount

B2B Merchants should be set up with our B2B Optimizer that will help them capture Level II and Level III Data automatically! Our software auto-fills the data fields that are required to comply with Level 2 and Level 3 data processing. The software allows B2B businesses to automatically comply with the data levels, retrieving them automatically upon purchase so your business can enjoy instant access to Level 2 and Level 3 savings (.050% - 1.00%) on interchange rates. These systems are also programmed to identify which cards qualify for Level 2 and Level 3 interchange savings, as not all credit card associations offer the same rates, and some have different policies for businesses to qualify. Optimizing this process and automatically collecting the correct data through the use of gateway tech platforms ensures that companies always remain compliant and qualified, setting them up to saving time and money.

If the majority of your business is with other businesses (B2B) then you NEED to speak to us about getting you on our B2B Optimizer Software. For less than $25.00 per month, you can save hundreds in merchant processing fees a month! Call us today!

Merchant Processing Solutions

954-938-2420

Friday, August 14, 2020

Consumers feel unsafe of in-store shopping!

How can you keep consumers shopping at your store?

In a recent survey by First Insight Inc, researchers found that as ALL major retailers require customers to wear masks in-store, 80 percent of women surveyed feel unsafe trying out beauty products, 68 percent feel unsafe trying on apparel in dressing rooms and 61 percent feel unsafe trying on shoes. This represents an increase compared to First Insight's last study in April 2020 when 78 and 65 percent of women felt unsafe trying on beauty products and apparel, respectively.

The study also found that, of the generations, baby boomers, who still represent the bulk of "dispensable income" feel the least safe returning to the physical shopping environment. Seventy-three percent of baby boomers surveyed said they would not feel safe trying on clothes in dressing rooms compared to 71 percent our First Insight's April study. Women with children also are avoiding retail shopping in fear of contracting the Covid-19 virus.

So what can retail merchants do? Create a website or enhance your current website and add a shopping card. People prefer to shop local but in the absences of local retail store with online presence for shopping, most shopping a buying with Amazon! Speak to your website designer about adding a shopping cart to your website soon! Merchant Processing Solutions can add the eCommerce payment gateway at a nominal fee!

Need to learn more on how to keep your retail doors open during the Pandemic?

Call Merchant Processing Solutions at 954-938-2420!

Tuesday, August 4, 2020

Tuesday, July 28, 2020

SQUARE MERCHANTS BEWARE!!!!

Merchants SQUARE off

against Dorsey and his brands!

"Mr. Weber said he had since had to miss the $3,000 monthly mortgage payment on his home while looking for a new payment processor," Popper wrote. "When he complained about Square's policy on Twitter, the company blocked him, something it has also done to other customers who have publicly brought up the issue."

Our Merchants are Open for Business and Growing!

While we continue to be plagued by the Covid-19 Virus in South Florida, businesses are trying to get back to business. South Florida is still in Phase 1 of the "economic recovery plan" in the Florida! How do you deal with the regulations, limits and penalties?

|

| Camilo Guzman |

He has designed a series of programs to work with the Clover POS and other POS Systems that allow Restaurants and Retails stores to not only open their business; but grow! He has implemented mobile app feature to ALL of his clients saving those restaurants 30-35% of each sale when they use Grub-Hub, UberEats, DoorDash etc! He has also helped them utilize the POS System effectively to capture customer data to use for text and email promotions/loyalty and rewards programs which help bring your customers back!

Check out our valuable customers today!

If you are looking to keep your doors open, avoid fraud and Chargebacks, and even grow your business in this New Reality, make an appointment today to see how our TEAM can help your business during these difficult times.

Merchant Processing Solutions

954-938-2420

Monday, July 13, 2020

Wednesday, July 8, 2020

Creating a Digital Mindset for your business!

Does your business have a Digital Mindset? A digital mindset is not merely the ability to use technology but implementing this technology into your business model to change employees' and customers' set of attitudes and behaviors to uncover opportunities to grow your business.

|

| Families live and work from home today! How can your business reach people that do not go out unless its urgent? |

| Build a easy to use website for your customers! Make sure you add the products and services they want and need along with a Payment Portal! |

Here are some business success stories within our community!

- Miami Restaurant: We no longer offer dining in but we got set up with a branded Mobile App, offering our best and most popular items along with either PICK-UP or DELIVERY options. Each order is PAID and we do a call back to make sure the order is real. We then prepare the order. We were able to keep most of our employees and our business is making enough with this option to keep the doors open!

- Weight-Lose Doctor: We are no longer meeting with our patients at the clinic. However, we are using TeleHealth and checking in weekly with our patients. We look at the physical progress, and consult on adjustments to their weight loss program. If they require supplements, we prescribe them. We then have patient go online to our Website and enter their payment for the consultation and any supplements before being shipped to them. We have kept all of our employees and have grow through this time as more people want to become healthier!

- Dance Studio: Dance studios usually have contracts for their services. How does a contracted company still offer the services when the facility is closed? They have ONLINE CLASSES! This local dance studio is offering their students live video classes. They can then send the parents the video so the child practices and sees any mistakes. This has been quite helpful and it allows this business to keep charging for their services! This business sets their customers up on recurring monthly billing up until their contract ends.

Tuesday, June 30, 2020

OMG!! I had more than 5000+ credit card sales????????

Businesses are so happy to be getting ANY BUSINESS they forget to do the basics, check their eCommerce Activity for Fraud! We heard of 2 businesses that had to pay a lot of money due to FRAUD to their merchant account! Merchants pay for the approvals and declines of credit cards, this FRAUD can be very costly for our merchants!

|

| Testing credit cards on YOUR WEBSITE can be very costly to your business! |

Scenario #1: Fraud perpetrators used the merchant's website to TEST credit card#s for authenticity. Once they see the card# is valid, they sell that number on the dark web! They used this merchant's website over 5000 times testing card numbers. These "DECLINES" have a cost and that cost went to the merchant. Solution: Tighten your website by making sure your website uses the FULL Resources available by your gateway to STOP FRAUD. Even it it makes your customer add more fields to the payment transaction, it protects your business! Get DECLINE Notifications if there is an occasional one or two; fine. However, if you start seeing a handful and more, call your gateway company to close your gateway until they investigate!

|

| Don't give anyone your credit card! Enter it YOURSELF in a secure gateway! |

Scenario #2: One business accepts credit cards for their services. They write the customers credit cards down and the employees from that business share the cards and make purchases on those cards!!!

Solution: If you are a customer/ NEVER give anyone your credit card over the phone! Enter your credit card into a SSL/Encrypted Gateway....ONLY! As a business, you need to call your gateway and report this incident. You can even call the Federal Trade Commission and report the company committing the

FRAUD and the FBI as they both take these types of FRAUD very seriously!

BEWARE!! If you are a business that allowed your employees to accept credit cards with NO SUPERVISION, you are liable for money and criminal actions.