VENMO, is a digital money-transfer service owner launched in 2009 and operated by PayPal Holdings Inc. For years, VENMO customers have been able to make payments to individuals, free of charge. Consumers just link a bank account, debit, or credit card to their app and pay people directly. Now, VENMO is offering merchants a chance to capture the millennial market (digital payment society) by getting set up as a "partner business"!

|

| Mobile to Mobile Payments |

How do you take advantage of VENMO as a payment source for your business? First of all, VENMO is NOT a in-person payment portal, it is strictly for online purchases via a MOBILE APP. You would need a mobile app and add VENMO to your list of supported and accepted payments. Mobile savvy users LOVE being able to make purchases using VENMO.

So what are the fees? While there is NO FEE for the customer to make payments via their bank account from peer to peer, there is a 3% fee if a users pays someone using a credit or debit card. The consumer actually gets charged the cost of the payment plus the 3% on their credit card. This is NOT what happens when accepting VENMO payments as a merchant. The Merchant pays the fees! If a merchant is a partner partner business, consumers can use any type of accepted payment and VENMO charges the business 2.9% of the transaction plus $0.30. The only good news is that there are no monthly subscription fees, annual charges, nor minimums you must meet.

What's the downside?

- You have to have a mobile app or online store

- All transactions are public knowledge

- There is no in-person payment acceptance connection

- You must have an IOSv4, Androidv2 or Javascriptv3 to be able to use VENMO App

- VENMO does not have a published list of accepted industries for merchant accounts. A merchant has to apply and wait to see if they are accepted.

- VENMO, like Square, can pull, hold or even freeze your account if they feel that there is any suspicious behavior.

- VENMO has been linked to consumer fraud issues. The VENMO APP frequently asks its users to re-enter their bank account or credit card info into the app. Recent reports should users have been "hacked" and lost thousands of dollars for their bank account or on their credit/debit cards.

- Consumers who pay a vendors for products or services at least $600 in a year using VENMO, are required to send that vendor a 1099 form unless it was for personal purposes only.

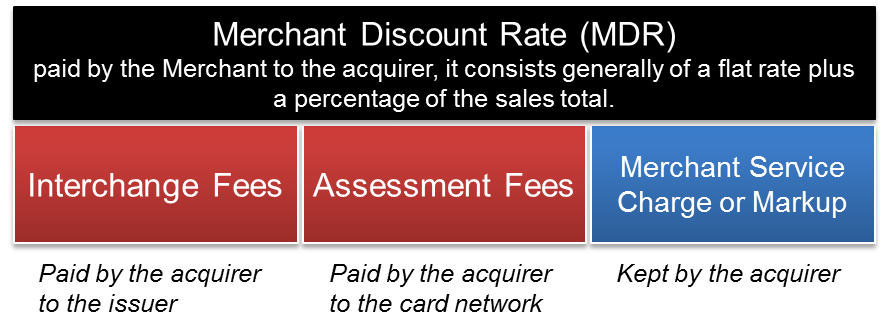

Bottom line, there will always be a number of ways for merchants to get paid and it may look to be lower fees. However, VENMO is not a free service to merchants! It's actually MORE EXPENSIVE than many typical merchant accounts. The most important thing to remember when setting up a merchant account is being set up correctly with Interchange Plus Pricing to give you the best pricing, minimal monthly fees and transparent processing!

If you are interested in knowing more, call Merchant Processing Solutions TODAY! 954-938-2420