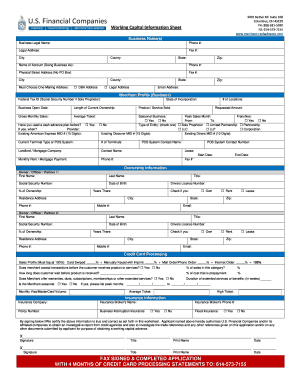

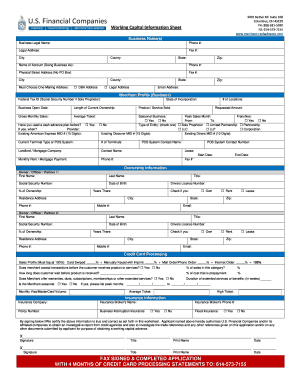

Interchange plus pricing is a credit card processing pricing structure that separates the components of the merchant processing costs and create transparent reporting. The interchange plus pricing allows for lower processing costs; compared to tiered or bundled pricing models.

Merchant Processing Solutions Inc practices this honest, fair and transparent pricing method. But what is it?

What is Interchange? The

What is Interchange? The Credit card processing rates set by the card brands (Visa, MasterCard, Discover). No merchant processing company can change or impact those set rates. Click on the link below to learn more about the hundreds of credit cards each with it's own negotiate rate between the issuing bank and the selected Brand.

MasterCard interchange rates

What is interchange plus or Pass-Through Pricing?

Interchange plus is a merchant account pricing model that has a fixed markup by the actual processor on top of the interchange fees (wholesale fees) published by Visa®, MasterCard® and Discover®. The “

Plus” refers to the processor’s markup that’s applied to each credit card transaction. The markup is typically expressed as basis points or a fraction of a percentage.

Basis Points

A basis point is equal to 1/100th of a percentage point.

Example: Visa’s current interchange fee for a swiped consumer credit card is (1.54% = 154 basis points). The merchant processor the merchant hires offers a flat fee on top of the set Visa Card Rate of .30% or 30 basis points of 30/100 or less than 1/3 of 1 percent.

|

| Basis Points are X/100 to determine percentage. 100 basis points = 1% |

Is interchange plus (X basis points) the most cost effective way to process?

Absolutely! If a credit card processor offers you Interchange Plus, they are going to pass on to you the actual Interchange Rate on each credit card by each Brand. You CANNOT negotiate the Interchange Rate but you can negotiate the "PLUS" from the processor. Here is where you must see how many basis points is the markup; the lower the better!

But merchants, it’s not only getting Interchange Plus Pricing Model, it's also making sure there are no other fees of additional Basis Points or fees being added!. If you simply focus on the basis points markup, you may miss other very important differentiators like the following:

- Minimum monthly Service Fee: usually $25

- Monthly Service Fee: usually $20

- Authorization Fees/CPU Fees and more than add up on each transaction

- A contract with a hefty cancellation fee

- PCI Compliance Fee (annual and monthly fees)

- Additional Basis Points that may be unknown but also going to the processor

Is Interchange Plus Pricing Model for all types of business?

Yes, however, a merchant needs to understand that there are several business types; Retail, Mail Order/Telephone Order, eCommerce, Point of Sale, Mobile. There are two main processing methods: Card Present/Card Not Present. The Interchange/Wholesale Rates for Card Not Present processing method is higher because of the potential for fraud to be present in those transactions! And lastly, the more entities involved in the transaction process like a bank/brand/processor/rep/etc. The higher the basis points can be because all those entities want to get a piece of your costs!!

How does the interchange plus pricing work? Examples:

$40.00 (Sale) x .05% (Debit Card Visa) + .30% (30 basis points) = .35% Rate Total Processing Rate: $.14

$40.00 (Sale) x 1.40% (Credit Card MasterCard) + .30% (30 basis points) = 1.70% Rate Total Processing Rate: $.68

$40.00 (Sale) x 2.25% (Rewards Credit Cards Visa) + .30% (30 Basis Points) = 2.55% Rate Total Processing Rate: $1.02

What are the benefits of interchange plus?

Interchange plus is the most transparent, cost-effective form of merchant account pricing. By passing interchange fees directly to merchants with a fixed markup by the processor, surcharges and hidden costs are generally eliminated. Depending on the markup, interchange plus pricing will yield a substantial savings over the same processing volume when compared to other pricing models such as tiered, bundled or enhanced recover reduce (ERR).

How can I tell if I am offered Interchange Plus Pricing?

Interchange plus is presented on the application as Pass-Through. Not Tiered or Bundled or ERR! You must also ask to see the basis points!

*Recently, I was trying to win over a new customer by explaining Interchange Plus Pricing. He insisted he had something better a flat bundled rate of 1.29% on all transactions! After asking how that can happen when some cards are as high as 3.50% on Interchange/Wholesale and what company would take such a loss, he gave me a statement. We immediately realized that he was indeed getting 1.29% (129 basis points on top of the Interchange/Whole Rate of Visa/MasterCard/Discover!!! That is almost 1% over the normal rate! Once he understood that, we easily won his business!!

Merchants are becoming more savvy on costs, merchants that stay away from their banks can negotiate good rates for Interchange Plus Pricing or Pass-Through Pricing. They can also negotiate no contract or cancellation fees and more! Don't be fooled by fast-talking sales reps that only jot down rates on a piece of paper. Give them your statement, get an "apples to apples" comparison. If you like what you see, have them sit down and go over the

contract! Don't be fooled, it is a contract, not a hand-shake! They will NOT LET YOU OUT OF YOUR CONTRACT IF YOU HAVE ONE! Avoid leases too unless it makes sense for your company! Interchange plus or Pass Through has the

potential to save you money on your processing fees but it not a guarantee.

If you like what you have read, call Merchant Processing Solutions Inc and get an true statement analysis, understand where and how your processing works and then let us show you how you can save money! Call Today: 954-938-2420