|

| Are you preparing your 2019 Business Plan? |

- Your Mission Statement: What is it that you want to achieve in 2019? Make sure you include: who, what, when, why and how you want to reach this achievement. Put projections/goals to reach within a month/quarter/6-month and 12-month period of time. Include sales volume, business growth and any expansion.

- Revisit and Analyze the market & your product/service: Is the product or service I sell, still selling? Is your target market still the same as it was when you started 2018? How does this target market want to be marketed to?

- Know your Competition: Check out your competition, how are they communicating to the target market and how do you differentiate your business/service/product from them!

- Organize Internally & Externally: Promote and praise good employees! Look at your superstars with praise, promotions & bonuses! Look your under achievers and ask how you can help them become superstars. Note the expertise and qualifications of each member of the team in your business plan and plan your strategies accordingly. Look at your external relationships like loyal customers/vendors and referral partners. How do they help your business and how can you grow that relationship?

- Sales and Marketing Strategies: Look at your marketing efforts by dollars spend VS sales made; how did you do? What marketing dollars gave back nothing? Which marketing efforts worked? Look at your competition, how are they communicating with their customers and POTENTIAL CUSTOMERS? Consult with professionals if you are spending aimlessly!

- Financial Strategies: This is where most businesses falter. They overspend and then find the business on a respirator! Sometimes it only looks like overspending because those running the business have NO TIME to actually sit down and review the spending and find alternate vendors or systems to minimize costs! How much does your time worth? Most smaller business owners do EVERYTHING! And you can't be an expert in everything. So, find yourself some vendors and ask for analysis of your current costs like:

- Telephone/Internet Systems

- Payroll Systems

- Insurances

- Bank Services

- IT Services

- Equipment Rental Services

These are only a few but you get the idea, there are many companies that will actually do this for you with NO FEES UNLESS THEY SAVE YOU MONEY! Once you have reduced your costs, funding future growth becomes much easier!

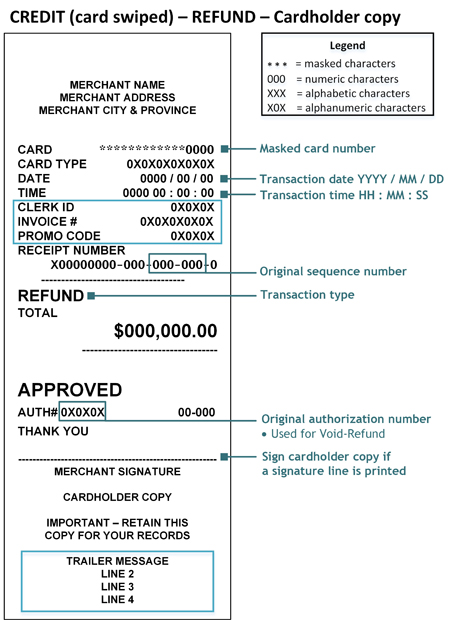

Merchant Processing Solutions wishes to offer any of our readers a FREE Statement Analysis to determine what they are paying and if it is a fair price to be paying. You can decide to go back to your own company and see if they will reduce their fees or we would be more than happy to partner with your business for your merchant services needs! Let us know!

Merchant Processing Solutions

954-938-2420