All brands of credit cards charge different fees. Within each brand, such as Visa, MasterCard, Discover, and American Express, there are card levels such as debit/credit cards/high-end rewards/business/corporate/shopping cards. Each of these is set at different rates depending on the bank issuing the cards and the brand they use.

WHAT ARE INTERCHANGE FEES?

When a customer pays with a debit or credit card, the bank that issued the credit card gets a portion of the transaction. This is called an interchange fee (or "wholesale" processing fee). It is intended to cover banks' operating costs and the risk of fraud. But they do not approve or finance that transaction. A business processing company does that service. They will add a fee in addition to the interchange fee to cover their processing fees, funding, and potential fraud risk.

Formula: Interchange Fee (Wholesale Cost) + Merchant Processor Fee = Your monthly business service fees.

AVERAGE EXCHANGE RATES

The typical interchange rate is 1.7% - 2% for credit cards and 0.5% for debit cards.

Here are the average credit card processing fees for the top 4 credit card networks:

Visa: 1.4% - 2.5%

Mastercard: 1.5% - 2.6%

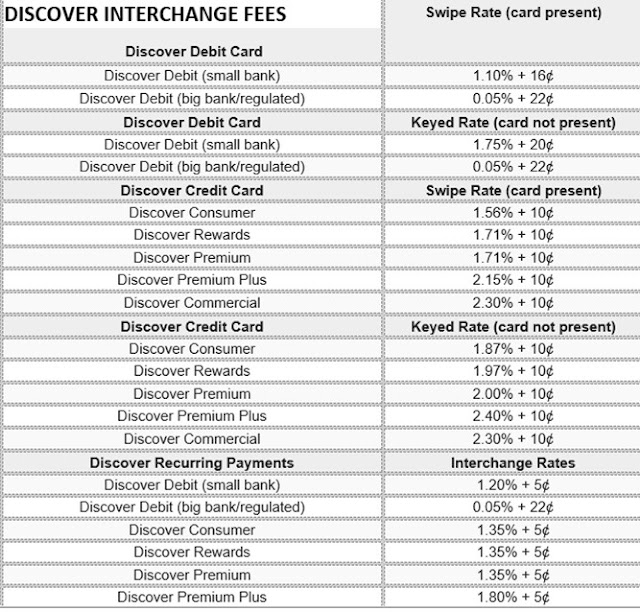

Discover: 1.55% - 2.5%

American Express: 2.3% - 3.5%

Below, are the most common interchange fees you can find for each card association, starting in April 2022.

Note: Credit card networks typically update their interchange fees twice a year, in April and October.

HOW IS YOUR RATE DETERMINED? WHICH METHOD IS THE BEST!

Flat Rate: There are companies that offer a flat rate for qualified/medium/unqualified cards. They usually range from 1.75% to 3.75%. The problem with these types of processors is that they group ALL CARDS in that category and charge more for debit than it should be, more for credit cards, and more if it is in personal or by phone or internet. Most merchants end up paying much higher than if they had used the Interchange Plus Pricing Method.

Interchange Pricing Plus combines the EXACT price given by the Brands; Visa/MasterCard/American Express/Discover and the processor add a FLAT FEE at the top for your part of the processing that includes device connections to the networks to process transactions, customer credit card transaction approvals, and funds to your bank account. You can't just use the BRANDS to process, you need a merchant processing company to help you combine the approval network with your bank account!

Diner's Club, Carte Blanc & JBC are cards we rarely see in the United States. Those cards, if taken, are paid through a check to your business at the end of the month. They are about 3% on each transaction.

I hope this explain has helped business understand why Merchant Processing Solutions offers a better pricing method, by offering Interchange Plus Pricing instead of a flat rate method. You save money and ALWAYS know what we are charging!

If you would like to know more about your rates, call us for a free analysis!

No comments:

Post a Comment