| Chargeback Disputes |

I know that we have talked about CHARGEBACKS before, but Merchant Processing Solutions Inc. wants to remind our merchants and all of our fellow business people that "buyer's remorse" is huge during the holiday season!

A purchased product or service does not perform as desired...they want their money back! They overspent on the holidays and start to return products or cancel services! The gift was rejected by the intended receiver and needs to be returned but it might be outside the return time frame. What do people do? They get upset and do CHARGEBACKS!

Accepting credit cards is very important to a business that wants to grow. It is said that companies see about a 40% increase in sales the first year after accepting credit cards over just cash and it grows from there! But with card acceptance can come the ominous "CHARGEBACK" issue! A CHARGEBACK is the return of money to a customer, initiated by the customer's credit card bank and used by the consumer to settle a disputed transaction against a merchant.

The CHARGEBACK process goes like this:

Step 1: A purchase occurs either in-person, online or mobile app.

Step 2: Customer initiates the CHARGEBACK because of the following reasons:

- After the customer reviews their credit card statement they notice a charge they didn’t make.

- The customer did not get satisfactory resolve on a purchase return and they feel they were treated unfairly.

Step 4: Decision time. The merchant submits via fax all the corresponding evidence to defend his position of NO REFUND. The merchant's processor/bank reviews all the proof provided by the merchant and they decide to reverse the hold on the funds in favor of the merchant or they return the money to the disgruntle customer!

Step 5: Customer is informed. At this point, the customer must accept the proof provided by the acquiring bank and either pay for the goods, or continue to dispute the purchase and begin a process known as arbitration.

Step 6: Arbitration. If the issuing bank and merchant bank fail to come to an agreement, as a last resort, they enter what’s called the arbitration process. The arbitration process is governed by the issuing credit card company, and its decision is absolutely final.

The credit card company (Visa, American Express, etc.) reviews the proof provided by the parties and has the last word on who must pay for the charges. If a merchant loses the arbitration process, they may choose to seek recourse and repayment in a court of law, at their own expense.

How can you avoid CHARGEBACK?

1. Follow processor protocol. Every credit card processor has its own protocol when it comes to accepting credit cards,be sure to check the expiration date and enter the security code on the front or back of the card. You may need additional info like:

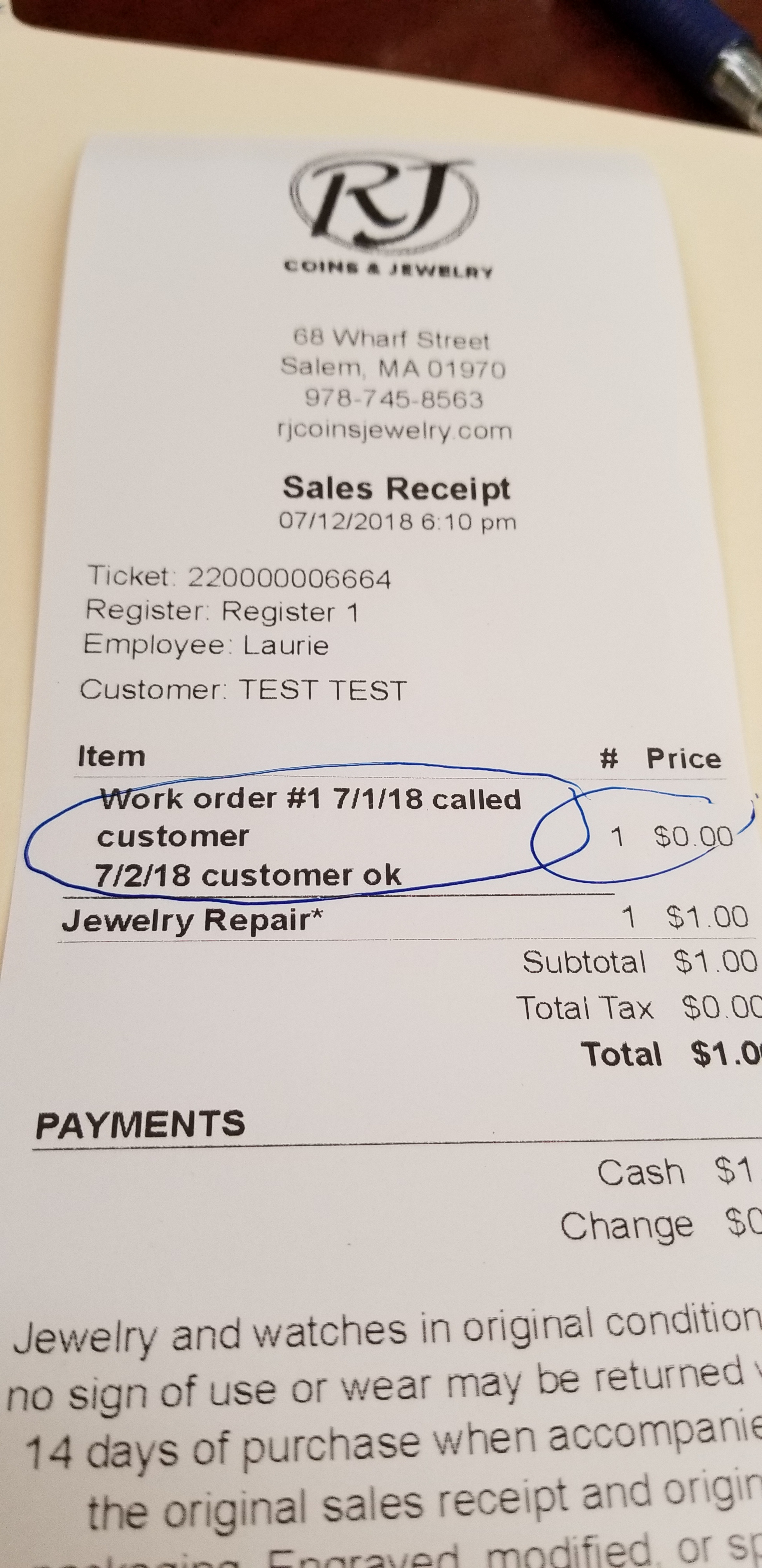

- Receipts - Some processors may want additional identity confirmation like front and back of credit card, driver's license and a signed letter authorizing the use of that credit or debit card online. Digital signature or social media profiles.

- Valid proof of shipping and signature or receipt from the customer.

- They will also look at the receipt to see that it has Terms of Refund or "Final Sale"

- They will also look at your website if purchase was online to make sure that your clearly state your Refund Policy, Warranty/Guarantee Policies!

2. Make sure that your business information is clearly shown on all customer documents including:

- Merchant name, address, phone number, website, customer service number.

- Make sure you put the name of the business that the customer knows like: Office Depot and not JJ Enterprises LLC!

- Make sure that any purchasing customer clearly knows the name of your business so they do not initiate a CHARGEBACK because they have NO IDEA who you are!

3. Get it in writing. Make sure that you require customer to sign all receipts to protect yourself. Have customers sign documents that clearly spells out the specific services being provided and whether there are any refunds on the product or service. Accept signed contracts via fax, email, Text or mail. DO NOT PROVIDE THE PRODUCT OR SERVICE UNTIL YOU GET THAT SIGNATURE!

4. Deal with customer service issues promptly. The best way to avoid losing a CHARGEBACK is to make sure your customers understand the return policy. Secondly, when they contact you about a problem, make sure your customer service people/you listen and try to negotiate the issue as a WIN/WIN for both parties! Remember, if you don't work it out, you might get a CHARGEBACK and lose the money. And you will DEFINITELY have a disgruntle customer that can hurt your business!

5. Learn to spot warning signs of fraud. Look out for people using fake credit cards, ID Cards. Make sure you send product to the place of business that is registered "legally" to your customer. NO PO Box. If you choose to send to a PO Box request a WireTransfer!

6. Train employees to properly accept both card-present and card-not-present transactions. A man trying to use a female's credit card is not a good sign! At that moment, request to see an ID that proves they have permission to use that credit card. NOT SALE IS WORTH GETTING A FRAUD CHARGEBACK!

7. Keep good records. Keep all receipts and signed customer documents for at least 180 days from the date of purchase. This is how long a customer has to dispute a charge.

8. Fight back when it makes sense. Each CHARGEBACK not only gets your money taken away for an undisputed transaction, but the credit card bank charges between $25 - $35 for each dispute. If you end up with a history of CHARGEBACK your merchant account may be shut down and consequently you will be only able to open an account with a "high-risk" provider at a much high rate! You NEED to devote the time and resources to each and every CHARGEBACK you get.

Merchant Processing Solutions Inc reminds you to put into motion ALL YOUR REFUND POLICIES TODAY, whether on your website, receipts, or printed on signs near registers. Train cashiers to remind customer of how many days they have to return purchases, if any. We are here to help our merchants have a GREAT Holiday Season!

Call Merchant Processing Solutions for more information: 954-938-2420

No comments:

Post a Comment