I KNOW I AM PAYING TOO MUCH FOR MY CREDIT CARD ACCEPTANCE!

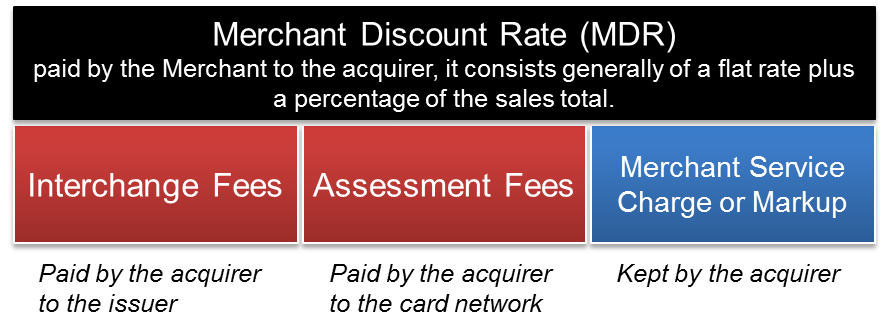

Discount rates are made up of three components:

- Interchange fees - Established by VISA/MasterCard/Discover & AMEX

- Assessment Fees - Established by VISA/MasterCard and given directly to them without that portion of the revenue being shared by the bank or processor.

- Visa charges: .13% for Credit Card Transactions & .11% for Debit Card Transactions

- MasterCard charges: .125% for both Credit & Debit Card Transactions

- Merchant Service Fees is comprised of a "markup" on the Interchange Rate (MPS charges Basis Points over the Interchange Rate), a transaction fee & a monthly service fee.

- There are also additional fees like PCI Compliance, IRS Regulatory Fees etc. Many of these are mandated by law.

Many merchants believe they are paying more today for credit cards than they were a few years ago. That is partially true! Here's why:

- With Globalization, Visa/MasterCard/Discover/American Express are now dealing with a global community. There are now additional fees when money crosses borders.

- Banks are taking a BIG CHUNK of the Discount Rate as a "kick-back" from the BRANDS for using a certain BRAND on their Debit and Credit Cards Issued to their customers.

- PCI Compliance, IRS Reporting and other such programs have made it necessary for processors to pass those fees on to the Merchant. Both have also implemented penalties if not adhered to!

- Credit Card Rewards Programs is one of the most used programs for consumers. Buy a TV and get money back, get points towards a hotel, cruise, airline mileage and almost anything on the market. Who doesn't want to get something back when they spend money? Unfortunately, those dollars, miles, points etc are ALL paid by increase discount rates for the Merchant!

Here are some of the whys you are not overpaying for payment acceptance!

- Most companies are no longer charging for start-up, Application or installation fees.

- Credit card machines are cheaper or given FREE by many companies. No one is Leasing Equipment unless they are looking for ongoing insurance and replacement.

- In the early 1990s, Interchange rates were averaging 1.75% for debit card purchases and 3.5% for card not present transaction. Today if you go the most economic route, with Interchange Plus Pricing, you will pay .05% - 1.38% for debit card purchases and an average of 2.10% - 2.40%.

Common 2019 Interchange Rate Examples

Swiped/Dipped Keyed/eCommerce

Basic Credit

1.51% + $0.10

1.80% + $0.10

Signature/Traditional Rewards Credit

1.65% + $0.10

1.95% + $0.10

Preferred Rewards Credit

2.10% + $0.10

2.10% + $0.10 / 2.40% + $0.10

Small Bank (Exempt) Debit

0.80% + $0.15

1.65% + $0.15

Big Bank (Regulated) Debit

0.05% + $0.22

0.05% + $0.22

| Swiped/Dipped | Keyed/eCommerce | |

|---|---|---|

Basic Credit

|

1.51% + $0.10

|

1.80% + $0.10

|

Signature/Traditional Rewards Credit

|

1.65% + $0.10

|

1.95% + $0.10

|

Preferred Rewards Credit

|

2.10% + $0.10

|

2.10% + $0.10 / 2.40% + $0.10

|

Small Bank (Exempt) Debit

|

0.80% + $0.15

|

1.65% + $0.15

|

Big Bank (Regulated) Debit

|

0.05% + $0.22

|

0.05% + $0.22

|

mERCHANTs MUST UNDERSTAND:

- The merchant discount rate is the rate charged to a merchant for payment processing services on debit and credit card transactions.

- The merchant must set up this service and agree to the rate prior to accepting debit and credit cards as payment.

- The merchant discount rate is a fee that merchants must consider when managing the overall cost of their business.

- Customers purchase today and make payments to their credit cards 30-45 days from the date of the purchase. Merchant Processors give the merchant their money USUALLY, the next day!

- Today's merchant will accept both in person and card not present transactions adding to the complexity and cost of payment acceptance. Therefore, it is important to work with someone like Merchant Processing Solutions that can help you manage both types of sales via multiple connecting devices!

For more information on how you can save money, call Merchant Processing Solutions Inc. TODAY! 954-938-2420

No comments:

Post a Comment